The possible solutions to the credit rationing faced by the SMEs are related with the improvement on the amount and quality of information generated by the sector in his relation with the financial system.

In the first place the classification in small and medium enterprise has to be defined according to the special feature of each economy. This is a common mistake that distorts the analyses and the policies to apply, more even this classification varies with the time as the economy is developed and its structure changes. In second term, as far as the specific problems and their possible solution we could mention:

* The `visibility' problems within the credit market could be improved with the access of the SMEs to the capital markets, creating a simplified legislation and reducing entrance costs. The creation of a stock-exchange board for this type of companies is an instrument used by some markets that usually produce good results if it is sufficiently supported by the government. The RGC (Reciprocal Guarantee Companies) or MGC (Mutual Guarantee Company)22 can also be used to improve the entrance on the credit markets.

* The internal information of the company and audit normally presents enormous gaps of information and quality. In this sense a possible solution would be to create accounting norms with specific international standards for the SMEs, as the IAS developed for large companies. In this case also the simplicity and low costs would have a fundamental importance to ensure the success of this tool.

* Another problem related to the previous point is the little interest of the credit rating companies to evaluate the credit quality of the SMEs adducing costs reasons, which is certain in most of the cases. These qualifications are very useful mainly for the entrance on the capital market. This situation could be moderated somehow with the support of the governmental authorities and the financial supervisors to lower the price of this `qualification cost'. To mention a case, in Germany exist a ‘record of private debt’ that facilitates the work of the credit rating companies23, in the same way the State recognizes that the SMEs does not have appropriate cost procedures reason why a large part of the consultancy subventions are directed to solve this difficulty.

* With respect to the problems of collaterals asked by the banks we’ve seen that the RGC normally gives good results when there’s a good coordination in between the agents involved, nevertheless their effects can be very limited towards a specific sector, thus the benefits of this instrument for the general sector is a little doubtful. In this sense we must remember that the requirements of collateral have direct relation with the information available (as we’ve seen on the section `Size of bank - Type of information'), therefore we could expect for a reduction on collateral requirements if the information available is improved by the measures mentioned in the previous points, this way would produce a much more ample effect than the obtained one with the RGC. * Also it is important to emphasize an endemic problem of the SME sector as it is the high dilatoriness with respect to the rest of the sectors. This is a characteristic without solution since it is inherent to his structure, nevertheless it can be reduced. In many cases the bankruptcy laws of some countries have particularly pernicious regulations for this type of companies, in this sense the legislation has to be improved taking into consideration their particular structure and increasing the possibilities of negotiation and solution previous to the ‘going to concern’ process.

* Finally we think that it is important to mention a structural aspect of the banking system as it is the reduction of branches, process that may be related to the banking concentration. If we compared the more developed financial systems we found in all of them a common pattern which is the high ratio of financial branches per capita, to mention some cases in the United Kingdom this relation was of 25 branches every 100,000 inhabitants, the same was 98 in Spain, 28 in Greece or 69 in Germany, whereas in Argentina that relation was of 12 branches by the same proportion of population. In the 90’s all these systems had some degree of concentration reason why we could say that the problem is not the concentration itself, but the maintenance of the necessary structure to efficiently attend the demands of the market. In this sense it is necessary that the development of medium banks or the correct distribution of the existing ones were stimulated. This problem in particular can lose relevance in the future if the technological advances can substitute the function of the branches.

However in the particular case of Argentina, that it is the empirical frame which we took for this work, some improvements have been performed from the end of the analyzed period to the present time. The access to the capital market has been stimulated by the Government and the CNV24 with the creation of the Panel de Acciones PyME (Chart of SME Equities) on December 2006. With this differentiated chart of negotiation the companies have access to different instruments like negotiable obligations emission, financial trusts and deferred payment check negotiation, and is even encouraging the financing through Venture Capital. The quotation regime has been simplified for these companies.

The participation of RGC has been also increased in order to canalize resources from the capital market towards the SME sector (20 RGC on 2007 with an amount of 587 ARG$ million, about U$S 185 million).

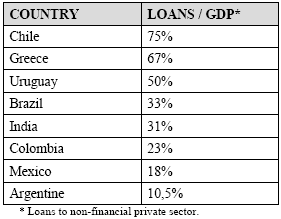

Nevertheless, the financial system is still undeveloped in terms of size and the volumes compromised in the FFS are small: as per official data loans are equivalent to 19,65% and deposits 34,16% of the GDP25. But in this case the situation is not very clear because the effects of the ‘Tango Crisis’ in 2001 are still latent, thus the actual size can be transitory and can experiment an important increase if the confidence in the economy attracts more capitals to the system (see Table 7).

Table 7. FINANCIAL SYSTEM DEVELOPMENT. LOANS TO GDP. APRIL

2007.

Source: BCRA and IMF

As some other obstacles to mention, the SME sector has to be redefined as the present parameters exclude several companies from official policy, in example the average gross income considered is ARG$ 42 million (around U$S 14 million) that is too low for the sector, in the same sense the maximum amount of Negotiable Obligations for SMEs is ARG$ 5 million (around U$S 1,6 million) clearly insufficient .

Como citar este texto:

Anonimo (01 de Sep de 2008). "Discussion". [en linea]

Dirección URL: https://www.econlink.com.ar/node/1260 (Consultado el 14 de Mayo de 2021)